Citigroup (C.N.) accidentally deposited $81 trillion into a customer’s account instead of $280 and took hours to reverse the transaction, the Financial Times reported Friday. This was a “near miss” that highlighted problems related to the bank’s operations, Efforts are being made to improve them. The mistake occurred last April, and was ignored by a payments employee and another official before the transaction was processed the next day, the FT reported, citing an internal account and two people familiar with the incident.

Citi made about 10 mistakes of $1 billion or more last year, down from 13 on the year before, according to an internal report seen by the FT. The city declined to comment to the FT on this report.

Last month, Citi CFO Mark Mason said the bank was investing more to address its compliance issues, citing regulatory penalties in terms of risk management and data governance.Mason also said, “We have recognized the need to invest further in data and technology to improve the quality of information we receive from our regulatory reporting.”

Last July, Citi was fined $136 million for little progress in tackling these issues, and in 2020, it was fined $400 million for certain risk and data failures.

Read more story at Reuters

What is near miss event in Banking?

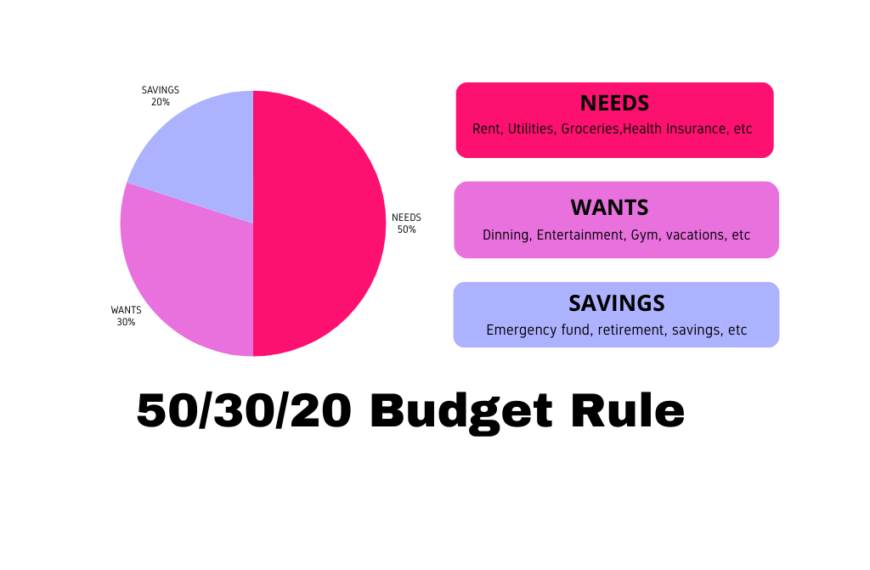

A near miss in banking is an operational risk event that occurs but does not result in a financial loss. If you want to learn how to save money, read our article here